The Benazir Income Support Program (BISP) has taken a significant stride towards empowering the less fortunate with the introduction of the BISP Savings Scheme 2023. This initiative is currently active in various cities and tehsils, including Muzaffargarh, Muzaffarabad, Neelam, Peshawar, Lucky Marwat, Quetta, Qila Saifullah, Lahore, Multan, Karachi, Sukkur, Gilgit, Melsi, Bahawalpur, Kahror, Pakka Khanpur, and Mianwali.

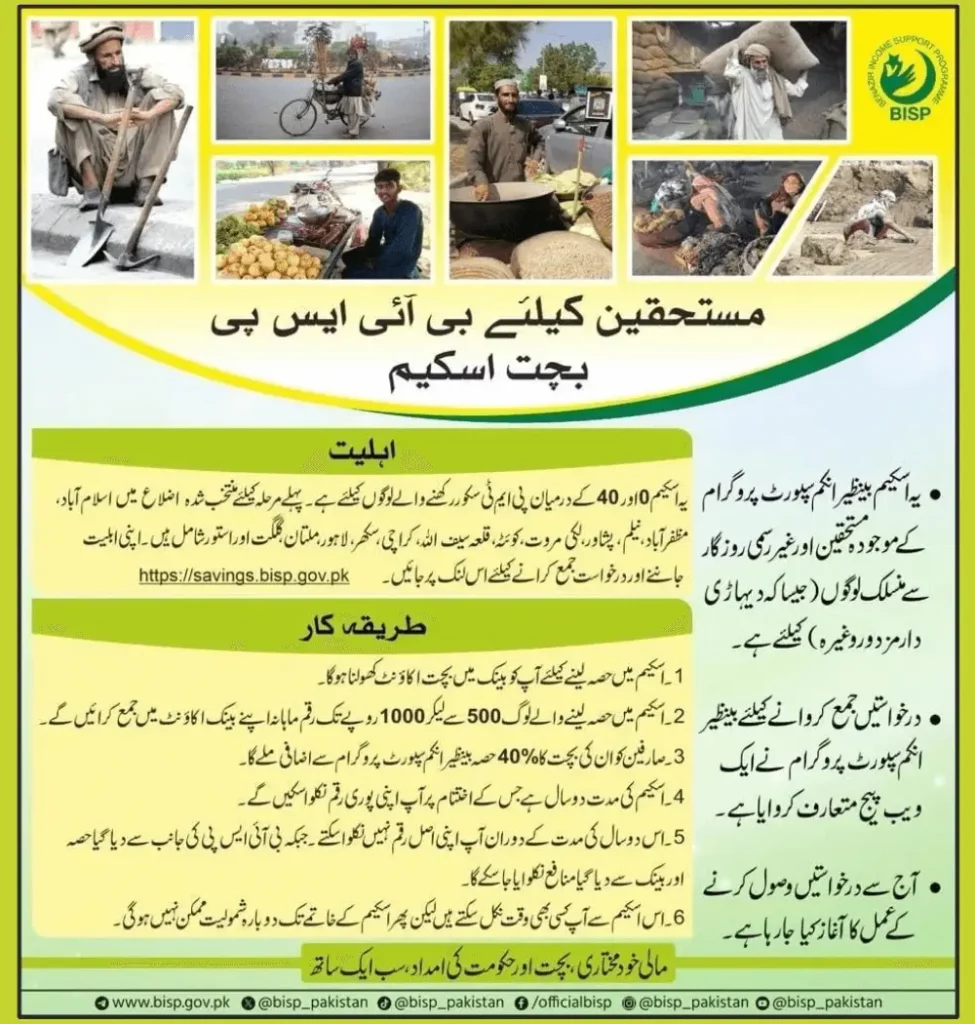

BISP Savings Scheme Launch

In a bid to foster financial independence among the impoverished, BISP has rolled out the Savings Scheme. This not only provides an avenue for savings but also ensures that those with a PMT score below 40%, indicating extreme poverty, can participate without any financial barriers. The application process is currently underway, with BISP staff actively collecting submissions.

Eligibility Criteria

For individuals aspiring to join the BISP Savings Scheme, meeting specific eligibility criteria is crucial. A PMT score of 35% or below, the absence of private house ownership, a monthly income ranging from 10 to 20 thousand rupees, and a household size of up to 7 members are prerequisites. This inclusivity allows even those with meager monthly earnings, like Rs 10,000 to Rs 12,000 for a three-member household, to participate seamlessly.

Registration Process

To become part of this transformative program, interested individuals need to follow a simple registration process. The government has provided a link that directs applicants to a portal where they can apply for the Savings Scheme. Entering their ID card number and following the instructions provided on the portal completes the application process.

Benefits of BISP Savings Scheme

Participants in the BISP Savings Scheme enjoy the privilege of having a savings account opened in their name. What sets this scheme apart is that those who deposit money into this account receive a generous 40% profit from BISP. This not only encourages savings but also acts as a financial boost for the participants.

BISP Savings Scheme for Laborers and Widows

Designed with a humanitarian approach, the BISP program primarily targets laborers and widows who lack a breadwinner at home or have an extremely low monthly income. This ensures that those who need financial support the most are included in the scheme.

Monthly Income and Household Size Considerations

The eligibility criteria take into account the varying socioeconomic conditions, allowing flexibility for different household sizes and income levels. This inclusiveness broadens the impact of the BISP Savings Scheme, making it accessible to a wider demographic.

Savings Scheme Requirements

Registering for the program is a straightforward process. Initially, individuals need to open a savings account in any bank or a specified bank mentioned by BISP. The scheme requires a monthly deposit of either Rs. 500 or Rs. 1000, providing an easy and manageable way for participants to contribute.

Profits and Duration

Upon successful registration and opening of the savings account, participants start receiving a 40% profit from BISP. This profitable arrangement lasts for almost two years, offering a sustained benefit to those involved. The flexibility of continuing or leaving the scheme after this period ensures autonomy for participants.

Linking Bank Account with BISP Scheme

An integral part of the process is linking the newly opened savings account with the BISP Savings Scheme. This step ensures a seamless flow of benefits to the participants and establishes a connection between the banking system and the social welfare initiative.

Continuation and Withdrawal

Participants can decide whether to continue or withdraw from the scheme after the initial two years. However, it’s crucial to note that leaving the scheme results in ineligibility for reentry. This policy encourages commitment and discourages frequent withdrawals.

Monthly Earnings and Deposit Process

The monthly deposit process is designed to be user-friendly, requiring participants to contribute either Rs. 500 or Rs. 1000 once a month. This hassle-free approach aims to encourage consistent savings and financial discipline among participants. The earnings from the scheme provide a significant financial boost to participants.

Socioeconomic Impact

Beyond individual benefits, the BISP Savings Scheme contributes to broader socioeconomic development by uplifting vulnerable communities. By targeting those with the highest need, the scheme becomes a tool for poverty alleviation and empowerment.

BISP Online by CNIC

For those seeking additional information or wishing to access BISP services online, the program provides an online portal accessible through CNIC. This user-friendly online platform enhances the convenience and accessibility of the program.

Conclusion

In conclusion, the Benazir Income Support Program’s Savings Scheme is a commendable initiative by the Government of Pakistan. By addressing the specific needs of laborers and widows, it not only provides financial support but also encourages responsible financial habits through regular savings. The inclusivity of the scheme ensures that even those with modest incomes can benefit, contributing to a more equitable society.

BISP Basic Information Required

| Information | Details |

| Contact Number | 0800-26477, 051-9246326 |

| Address | Benazir Income Support Program, Block F, Pak Secretariat, Islamabad, Pakistan |

| Registration Document Required | CNIC, B-Forms, Mobile No, Gas/Electricity Bill, Home Rent Agreement if Available. |