In today’s fast-paced world, managing your auto loan payments should be simple and convenient. BMO Harris Bank recognizes this need and offers a hassle-free solution through its BMO Harris Express Loan Pay Program. This innovative program allows you to effortlessly manage your loan payments with ease and flexibility. Let’s dive into the details of this user-friendly service that ensures your auto loan payments are a breeze.

1. Introduction to BMO Harris Express Loan Pay

The BMO Harris Express Loan Pay Program is designed to simplify the auto loan payment process. Whether you’re an existing BMO Harris Bank customer or considering becoming one, this program offers you an efficient way to manage your loan payments.

2. Payment Flexibility

One of the standout features of the BMO Harris Express Loan Pay Program is its payment flexibility. You can conveniently make payments through your bank account or debit/credit card from the comfort of your own home. Plus, you can schedule future payments, set up recurring payments, and even pay multiple loans with a single transaction.

3. Effortless Loan Management

With the BMO Harris Express Loan Pay Program, you gain the power to make lump sum payments, modify due dates, and access your entire payment history online. This level of control empowers you to stay on top of your loan repayment schedule effortlessly.

4. Enrolling in BMO Harris Express Loan Pay

To get started with this convenient program, you need to meet specific eligibility criteria. You must be the primary account holder of an eligible BMO Harris auto loan, at least 18 years old, and either a U.S. citizen or permanent resident. During the account creation process, you’ll provide essential information, including your full name, email address, phone number, physical address, and your BMO Harris auto loan account number. Your data is safeguarded through encryption and strong authentication protocols.

5. Simple Account Setup

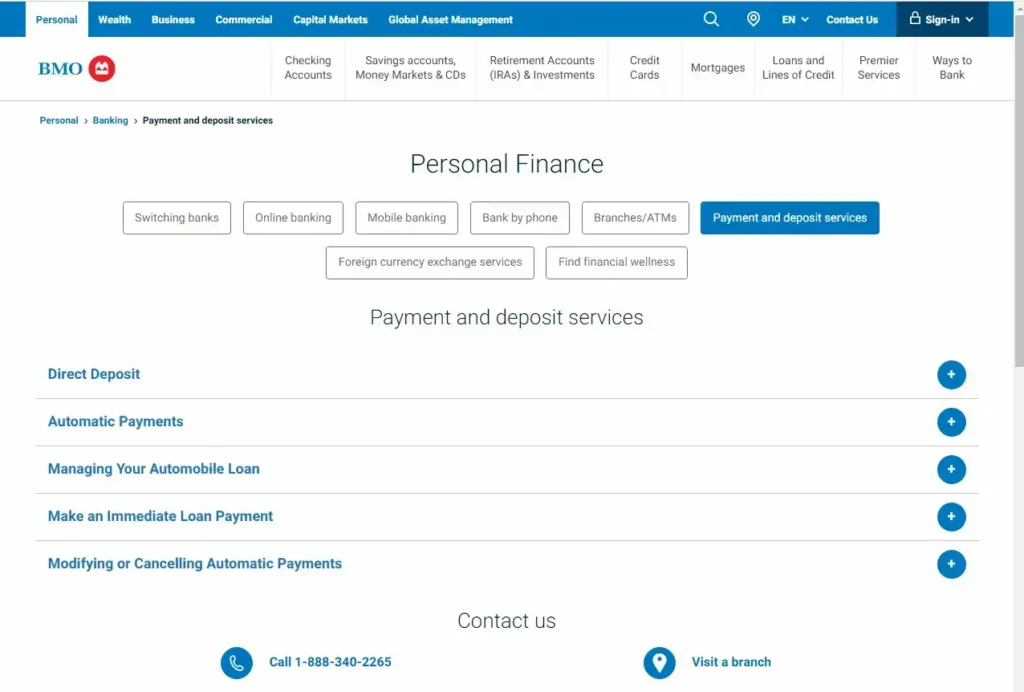

Setting up your BMO Harris Express Loan Pay account is straightforward:

- Visit the BMO Harris Express Loan Pay website.

- Click the “Sign Up” button in the top right-hand corner.

- Provide your basic information.

- Verify your information using the security code sent to your email or mobile number.

- Create a strong and secure username and password.

- You’re all set to make payments from home.

6. Benefits of BMO Harris Express Pay

This service provides a host of benefits:

- Secure and Convenient: Payments are fast, secure, and accessible 24/7.

- No Fees: Enjoy the service without any additional costs.

- Easy Money Management: Send and receive money to/from anyone with a U.S. bank account or debit card.

- Request Payments: Simplify bill splitting with friends and family.

- Transaction Tracking: Easily keep an eye on your payment history.

7. Keeping Your Information Up-to-Date

Maintaining current account information is essential for smooth loan payments. Follow these steps:

- Log in to your BMO Harris Express Loan Pay account.

- Visit the “My Account” page and update your information.

- Click “Update” to save changes.

- Review your payment history for accuracy.

- If you need to make changes to your payment due date or loan term, contact BMO Harris Auto Loan Express Pay customer service.

8. Understanding Your Loan Terms

Understanding the terms of your loan is crucial. Familiarize yourself with the loan amount, interest rate, and payment schedule before agreeing to any loan. If you have any questions, don’t hesitate to seek clarification from your lender.

9. Interest Rates at BMO Harris

Interest rates on personal loans at BMO Harris vary based on factors such as the loan amount, duration, and creditworthiness. Typically, the APR ranges from 5.99% to 24.99%. Individuals with better credit scores may qualify for lower rates.

10. Conclusion

The BMO Harris Express Loan Pay Program is a valuable tool for managing your auto loan payments with ease. It offers you the flexibility and convenience you need to stay on top of your finances. By keeping your account information up-to-date, understanding your loan terms, and making the most of the benefits this program provides, you can efficiently pay off your auto loan. Don’t wait; sign up today and experience the convenience of this program for yourself.

Frequently Asked Questions

1. Who is eligible for the BMO Harris Express Loan Pay Program?

To be eligible, you must be the primary account holder of an eligible BMO Harris auto loan, at least 18 years old, and either a U.S. citizen or permanent resident.

2. Are there any fees for using BMO Harris Express Pay?

No, there are no fees for using this service. It’s a cost-effective way to manage your loan payments.

3. Can I make lump sum payments using BMO Harris Express Loan Pay?

Yes, the program allows you to make lump sum payments, giving you greater control over your loan repayment.

4. How do I change my payment due date or loan term with BMO Harris Express Loan Pay?

To make changes to your payment schedule or loan term, contact BMO Harris Auto Loan Express Pay customer service for assistance.

5. What should I do if I have questions about my loan terms or interest rates?

If you have any doubts or questions about your loan terms or interest rates, it’s best to reach out to BMO Harris directly for clarification. They can provide personalized information based on your specific situation.