In a world where sustainability and eco-friendliness are becoming increasingly important, Meezan Bank has introduced a groundbreaking initiative to make renewable energy accessible to its customers while adhering to the principles of Sharia. This innovative approach offers a seamless solution to Pakistan’s energy woes while also addressing financial constraints through interest-free financing. Let’s delve into the details of Meezan Bank’s Interest-Free Solar Panel System.

Harnessing the Power of the Sun

Meezan Bank’s solar panel financing program paves the way for environmentally conscious individuals to embrace solar energy. With flexible payment plans and competitive pricing, it ensures that renewable energy is within the reach of all. This initiative promises to reduce electricity bills by a staggering 50%, making it not only an eco-friendly choice but a financially sound one.

Shariah-Compliant Financing

What sets Meezan Bank’s offering apart is its commitment to Sharia-compliant practices. The interest-free nature of their solar panel financing aligns with Islamic principles, making it a viable option for those who seek ethical and sustainable solutions.

Powering a Sustainable Future

Solar homeowners, in particular, stand to benefit from this initiative. They not only generate their own electricity but also have the opportunity to sell excess power back to the national grid through a process called net metering. This not only reduces individual electricity costs but contributes to a cleaner environment on a larger scale.

Eligibility Criteria

To participate in this innovative program, individuals must meet specific eligibility criteria. These criteria include:

1. Salaried Individual (Permanent Job)

Applicants must be employed in a permanent job to qualify for Meezan Bank’s solar panel financing.

2. Nationality and Age

- Applicants must be Pakistani citizens with a valid national identity card.

- The minimum age to apply is 20 years, with a maximum age limit of 60 years.

- Co-applicants can be up to 75 years of age.

3. Employment Status and Income

- Applicants must have a permanent employment status.

- The minimum monthly salary requirement is one lakh (100,000 PKR).

4. Job Tenure and Tax Compliance

- Applicants should have a minimum of two years of continuous employment.

- They should be registered tax payers with a valid National Tax Number (NTN).

5. References

Applicants are required to provide at least two certificates as references.

6. Account in Meezan Bank

If an applicant does not already have an account with Meezan Bank, one will be opened to facilitate the financing offer.

Product Details

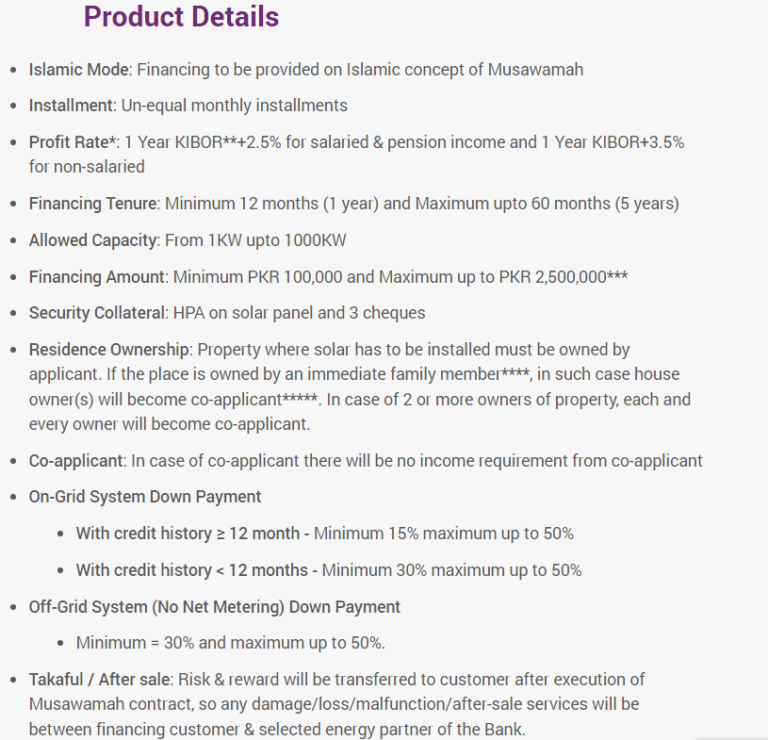

For those interested in the specifics of Meezan Bank’s solar panel offering, here are the key product details:

- Solar Panel Price: The pricing is competitive and designed to make renewable energy accessible to a wider audience.

- Specifications: Detailed technical specifications ensure you understand the capabilities of the solar panel system.

- Expert Guidance: Throughout the financing process, customers have access to expert guidance to help with pricing and decision-making.

Conclusion

Meezan Bank’s Interest-Free Solar Panel System is a significant step towards a sustainable and eco-friendly future in Pakistan. It not only empowers individuals to harness the sun’s energy but also does so in a manner that adheres to Sharia principles. By providing a pathway to reduce electricity bills and contribute to a cleaner environment, Meezan Bank is changing the way we think about renewable energy.

FAQs (Frequently Asked Questions)

1. How does the interest-free financing work?

Meezan Bank’s financing is structured without any interest, making it Sharia-compliant. Instead, they charge a service fee, making it an ethical option for financing solar panels.

2. Can I sell excess energy back to the national grid?

Yes, through net metering, you can sell any surplus energy generated by your solar panels back to the national grid.

3. Is this program open to businesses or only individuals?

As of now, this program is designed for individuals, particularly salaried individuals with permanent jobs.

4. What is the minimum and maximum solar panel system size available?

The system size can vary, and Meezan Bank offers flexibility to suit different needs, from residential to commercial setups.

5. How do I apply for this program?

To apply, you need to meet the eligibility criteria mentioned in the article and then visit the Meezan Bank branch to initiate the process.

Costs Involved

| Type of Charges | Chargers |

| Processing Charges | PKR 5,000 + FED |

| Documentation charges | At Actual |

| Late payment charges | Nil |

| Meezan Energy Partner survey charges | At Actual (if any) |

| Termination | Can be terminated anytime by paying remaining installments |

| STR Fee | PKR 1,000 |

1. Visit a Balance Bank Branch

To initiate the application process, visit your nearest Balance Bank branch. They will provide you with all the necessary information and guidance to apply for interest-free solar panels.

2. Helpline for Information

If you have questions or need more details before you visit the bank, you can call the helpline at 111-331-331 or 111-331-332. The bank’s representatives will assist you in understanding the process and eligibility criteria.

3. Get a Quotation from Solarjee Partner with Mizan Bank

Before applying, it’s essential to get a quotation for the solar panel system you wish to install. Solarjee, in partnership with Mizan Bank, can provide you with this quotation. It’s a crucial step in determining the cost of your solar panel setup.

4. Prepare the Required Documents

To streamline the application process, make sure you have all the necessary documents ready. Here’s a checklist of what you’ll need:

5. Meezan Solar Application Form

Once you have all the required documents in order, you’ll need to fill out the Meezan Solar application form. You can obtain this form from the bank or download it online.

6. Interest-Free Solar Panels on Independence Day

Meezan Bank celebrates Independence Day by offering you a fantastic opportunity. You can install solar panels at your home with easy installments and without any interest. Take advantage of this limited-time offer and contribute to both your energy savings and the environment.

7. General Documents

For all applicants, regardless of their employment status, you will need the following documents:

- Property ownership proof

- Current electricity bill

- Properly filled application form

- Copy of valid CNIC (Computerized National Identity Card)

- One photograph

- Signature verification form

- Declaration of financing

- A valid quotation from Meezan Bank’s authorized Solar Vendor

8. Salaried Applicants

If you are a salaried individual, you will also need the following documents:

- Latest pay slip

- Employment letter

- Proof of date of joining (DOJ)

- Proof of employment status

- Six months’ bank statement

- Audited financials and letters from the company if you are a paid director

9. Self-Employed Businessman Applicants

Self-employed individuals should provide specific documents based on their business type:

Sole Proprietorship

- NTN (National Tax Number)

- Bank proprietorship letter

- Tax returns

Partnership

- Partnership deed (latest and previous, if any)

- Certificate of the registrar of firms (if registered)

- Six months’ bank statement (of the firm or the applicant partner)

Limited Companies

- Memorandum of Articles

- Association of Articles

- Certificate of Incorporation

- Latest Form-A

- Latest Form-29

- Audited Financials

- Six months’ bank statement (of the company or the applicant director)

10. Pensioner Applicants

If you are a pensioner, the following documents are required:

- Copy of the pension book/certificate showing pension (must be issued from AGPR or the provincial office of the accountant general)

- Six months’ bank statements reflecting net pension credited to the account.

Now that you are well-prepared with all the necessary documents, head to your nearest Balance Bank branch and submit your application. Once your application is approved, you can enjoy the benefits of interest-free solar panels for a greener and more sustainable future.

Conclusion

Embracing solar energy is a smart and eco-friendly choice. Meezan Bank’s interest-free solar panels offer an excellent opportunity to make this switch. By following the application process and providing the required documents, you can start enjoying the benefits of solar power without any interest charges.

FAQs

1. Can I apply for interest-free solar panels if I don’t have an account with Meezan Bank?

Yes, you can apply even if you don’t have an account with Meezan Bank. However, you may need to fulfill additional requirements as a non-account holder.

2. How long does it take to get the solar panel system installed after the application is approved?

The installation time may vary, but it typically takes a few weeks to get your solar panel system up and running.

3. Is the Independence Day offer a limited-time promotion?

Yes, the offer for interest-free solar panels on Independence Day is a limited-time promotion, so make sure to take advantage of it while it lasts.

4. Can I install solar panels on a commercial property as well, or is it only for residential use?

Meezan Bank’s interest-free solar panels can be installed on both residential and commercial properties, making it a versatile option for various customers.

5. What is the warranty on the solar panels provided by Meezan Bank?

The warranty details may vary depending on the specific solar panel system you choose. It’s essential to inquire about the warranty when obtaining a quotation from Solarjee.